Not Sure Where You’ll Retire? That’s Okay.

USA? Europe? Back home in India? You may not know today. And that’s perfectly fine. But here’s one thing you can’t be unsure about: retirement will happen. Financial freedom is not optional. It’s the foundation of everything else.

At Aikeyam Wealth, we help NRIs design a plan that works anywhere you live. Because while your address may change, your financial freedom should never be at risk.

What You Get When You Work With Aikeyam

At Aikeyam Wealth, we bring structure, research, and accountability to your investing. Our 5-step fiduciary framework ensures your money works harder — and smarter:

What is NRI Investment Advisory?

Being an NRI comes with opportunities — and challenges:

- Investments scattered across India and abroad

- Multiple tax laws and compliance issues

- Currency risks reducing returns

- Offshore products like ULIPs or policies that don’t serve you well

- No clear retirement or repatriation strategy

NRI Investment Advisory Services

bring all of this together into one clear strategy. It ensures

- A unified global investment & wealth management plan

- Access to GIFT City investments (IFSC) for world-class diversification

- Reduced tax leakage with NRI taxation services and RNOR golden window planning

- Retirement strategies that work whether you retire in India, abroad, or both From clutter to clarity — that’s what true advisory means.

How Does Aikeyam help NRIs?

At Aikeyam Wealth, we don’t sell products. We build strategies.

As a SEBI-registered fiduciary, our only commitment is to you.

How We Manage Global Investments

- Consolidate Indian + overseas assets into one strategy

- Apply global asset allocation to balance risk and growth

- Provide access to GIFT City investments (IFSC)

How We Simplify NRI Taxation

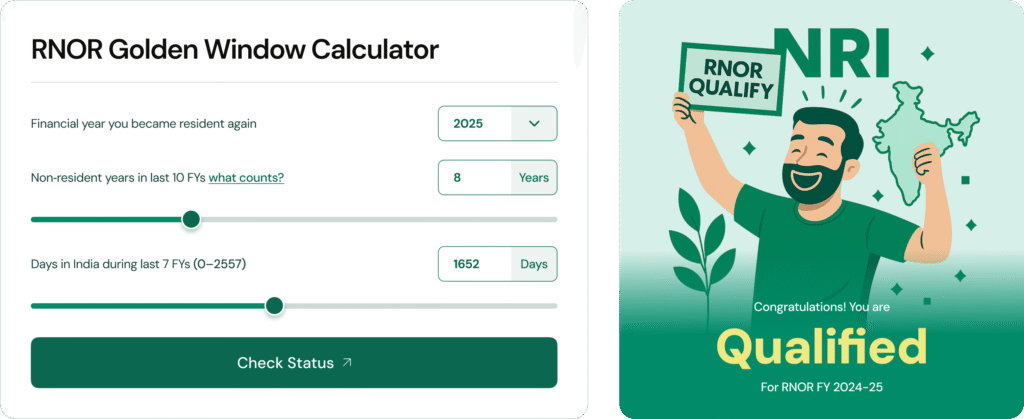

- Plan around the RNOR golden window for tax savings after you return

- Use DTAA to avoid double taxation

- Optimise capital gains on both Indian and global holdings

How We Plan NRI Retirement

- Build retirement income across INR, USD, EUR, GBP

- Inflation-proof and healthcare-ready portfolios

- Withdrawal strategies that work globally

Comprehensive NRI Financial Planning

- Map assets, liabilities, and goals across geographies

- Create one integrated roadmap covering investments, taxes, retirement, estate

- Ongoing reviews to adapt to life and law changes

Helping Returning NRIs

- Consolidate scattered global assets

- Exit costly offshore products (ULIPs, endowments)

- Reset portfolio for India while retaining global exposure

Case Study

From Scattered Assets to Strategy

Profile

A 45-year-old professional in the USA with $600,000 (₹5 Cr+) across Indian mutual funds, US tech ESOPs, and rental property in Europe. Planning to return to India in 5 years.

Challenge:

- Overexposed to US tech stocks

- Low-yield European rental property with tax hassles

- No RNOR strategy for return

- No unified plan

Challenge:

- Designed a global asset allocation plan to reduce risk

- Helped sell European property → reinvested into diversified funds + GIFT City (IFSC)

- Built a RNOR golden window tax plan

- Structured retirement income across INR and USD

Results

Growth outlook: 5.5% → 8.4% p.a

Achieved in 90 days

Projected tax savings

₹40 lakh during RNOR years

Liquidity

50% of portfolio accessible in 7 days

Stronger stability,

Reduced reliance on ESOPs

Returning NRI Checklist

Moving back to India? Don’t just pack bags — pack your finances right.

This checklist helps you avoid costly mistakes and prepare your wealth for a smooth transition

Avoid costly mistakes

- Review NRE/NRO/FCNR accounts and decide which to close/convert

- Check RNOR eligibility and plan withdrawals

- Consolidate global investments into a simplified portfolio

- Exit unsuitable offshore insurance or ULIP products

- Repatriate funds with FEMA compliance

- Time capital gains realisation to minimise tax

- Reset asset allocation for India + global exposure

- Review wills, estate, and succession plans across jurisdictions

Why Choose us

Why Do NRIs Choose Aikeyam Wealth?

We’re committed to providing exceptional financial guidance with integrity and expertise

SEBI-Registered Fiduciary

Unbiased, client-first advice

One-Stop NRI Solutions

investments, tax, retirement, estate planning under one roof

Global + Local Expertise

deep understanding of Indian & international finance

Experienced Authority

guided NRIs across USA & Europe through complex transitions

Clarity Over Chaos

turn scattered wealth into a growth-focused plan

FAQs

Frequently Asked questions

We’ve got answers! explore our FAQs to learn more about how Aikeya can enhance your wealth.

01 What is the RNOR golden window and why does it matter?

RNOR (Resident but Not Ordinarily Resident) status lets returning NRIs avoid tax on global income for up to 2–3 years. We help you use this to save significant taxes.

02 Are GIFT City investments (IFSC) safe for NRIs?

Yes. Regulated by IFSCA, GIFT City offers tax-efficient access to global-grade funds and bonds, making it ideal for NRIs.

03 How is NRI financial planning different from resident planning?

It involves cross-border taxation, foreign exchange risk, FEMA compliance, estate planning across jurisdictions — complexities that resident-only planning doesn’t face.

04 How can NRI taxation services save me money?

By leveraging DTAA, RNOR status, and capital gains planning, you avoid double taxation and minimise tax leakage.

05 Can you help if I’m returning to India soon?

Yes. Our Returning NRI Advisory consolidates overseas assets, exits unsuitable products, and builds a strong India-focused portfolio while retaining global exposure.

More Services

Financial Planning

Comprehensive Financial Planning in India for Professionals & NRIs

Insurance Planning

Insurance Planning Services – Your Financial Umbrella for Life’s Rainy Days

Investment Planning & Management

Investment Planning & Management Services in India | SEBI

NRI Investments

Your wealth is global. Your freedom is personal. We make both work

Income & Expenses Planning

Tax Planning & Capital Gains Advisory Services

Retirment Planning

Professional Retirement Planning Services in India | SEBI-Registered

Tax & Capital Gains Planning

Tax Planning & Capital Gains Advisory Services

WIll & Estate Planning

Most families postpone estate planning and end up paying for it later